Wealth simple income tax calculator

This calculator helps you to calculate the tax you owe on your taxable income for the full income year. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

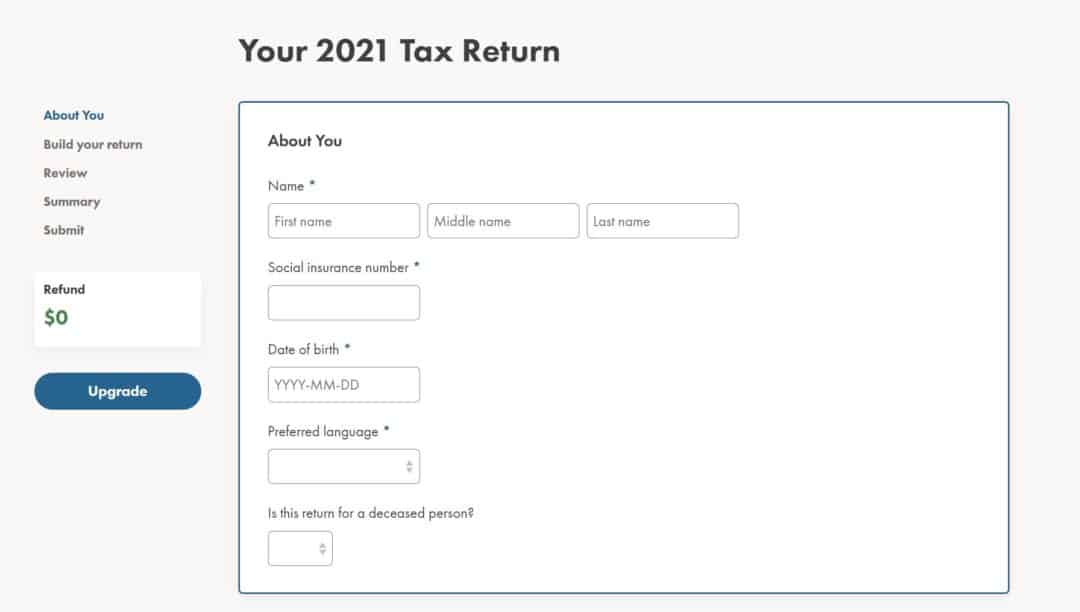

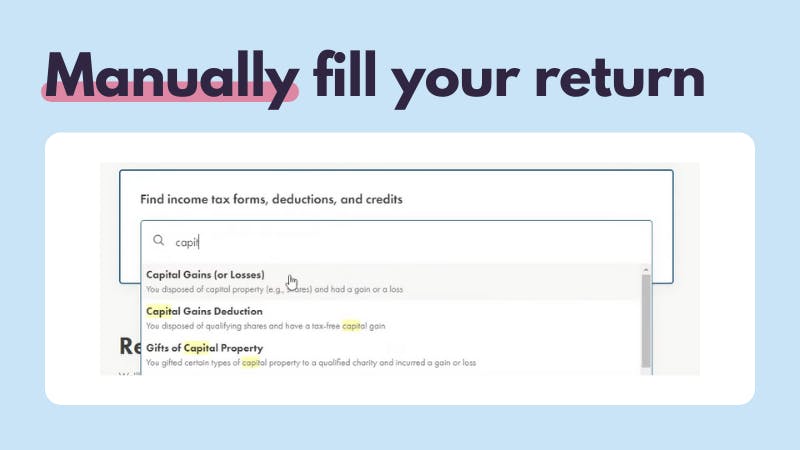

Meet Wealthsimple Tax

Enter your filing status income deductions and credits and we will estimate your total taxes.

. Calculate the taxes already paid during the financial year. Our Income Tax Calculator allows you to research how much income tax and National Insurance Contributions you may have to pay from your earnings. And is based on the tax brackets of 2021 and.

Elizabeth Warren D-MA recently proposed a wealth tax on the very rich as a way to curb wealth inequality. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Do more with your money with our smart financial tools and expert advice.

Your household income location filing status and number of personal. Ad Try Our Free And Simple Tax Refund Calculator. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Its a simple 2 percent tax on fortunes over 50 million and a 3. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

Calculate the Tax Payable. Based on your projected tax withholding for the year we can also estimate your tax refund or. Calculate the tax payable for the financial year at the applicable income tax slab rate for FY 2022-23.

It is mainly intended for residents of the US. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. 100 Accurate Calculations Guaranteed.

Wealthsimple is the smart way to invest trade save spend and file your taxes. Our income tax calculator calculates your federal state and local taxes based on several key inputs. It can be used for the 201314 to 202122 income years.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Your household income location filing status and number of personal. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Wealthsimple Tax Simpletax Review 2022 Savvynewcanadians

Wealthsimple Tax Review 2022 Formerly Simpletax Greedyrates Ca

Wealthsimple Review 2022 Investing App For Canadians Fees Pros Cons

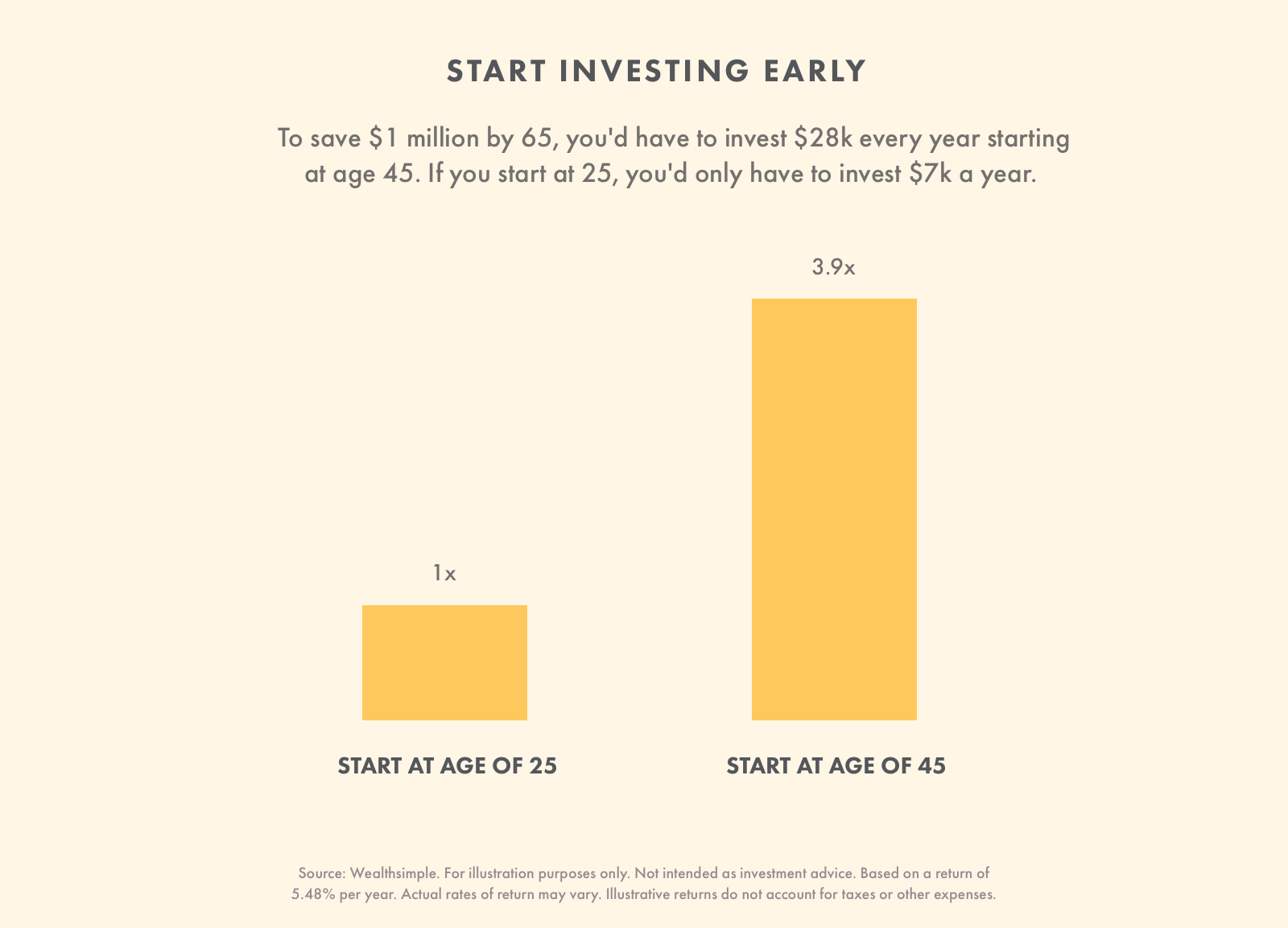

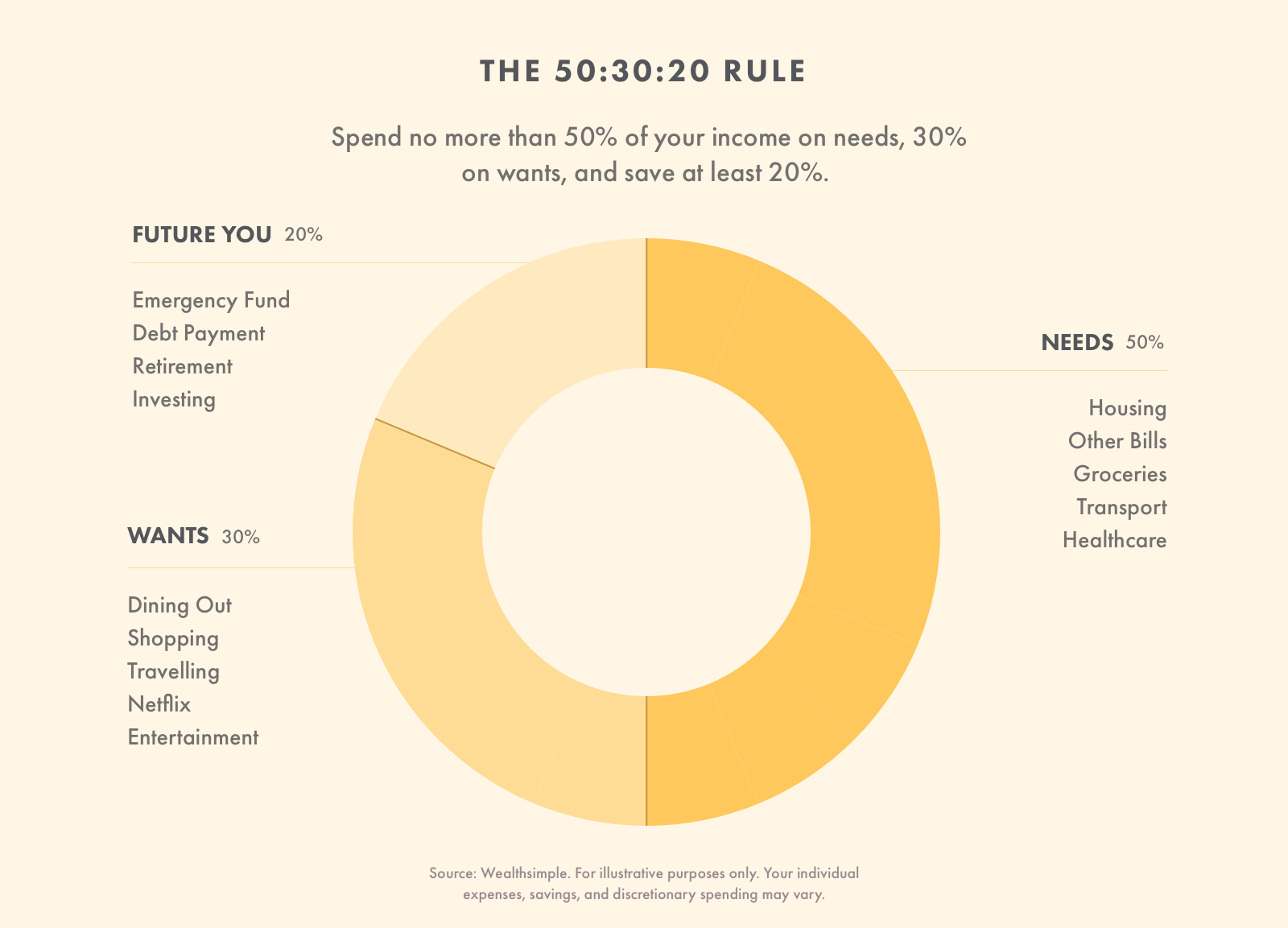

How To Make A Budget Wealthsimple

How To Make A Budget Wealthsimple

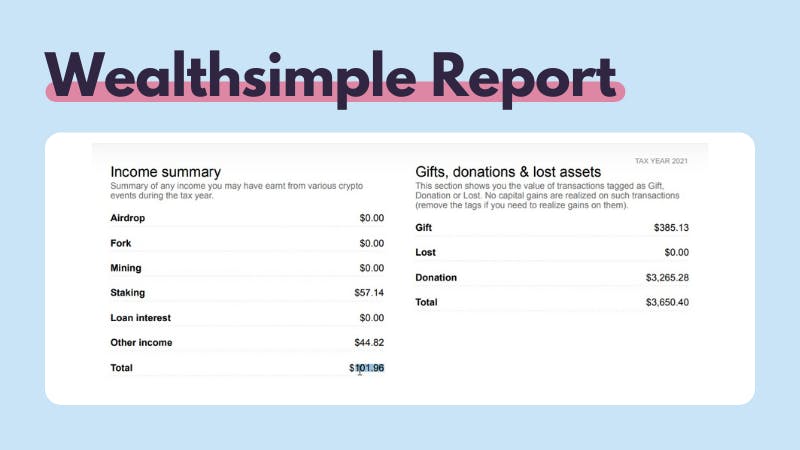

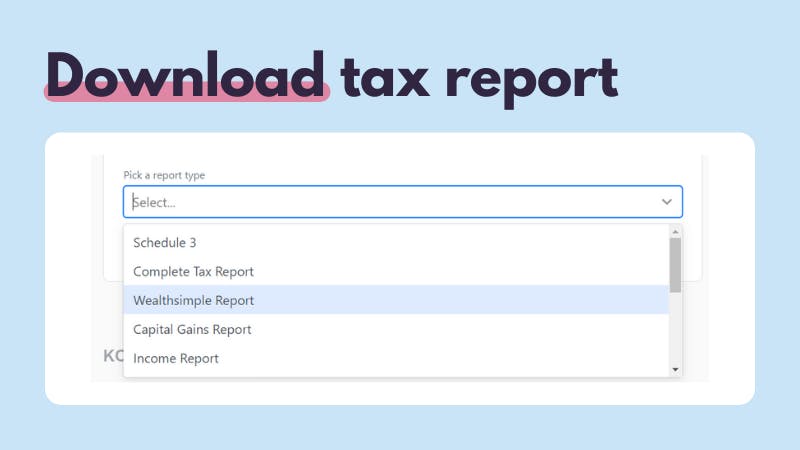

How To Do Your Wealthsimple Crypto Taxes In 2022 Koinly

Wealthsimple Tax Simpletax Review 2022 Savvynewcanadians

Wealthsimple Review Pros Cons Bonus Offer

How To Do Your Wealthsimple Crypto Taxes In 2022 Koinly

Wealthsimple Tax Review 2022 Formerly Simpletax Greedyrates Ca

Wealthsimple Tax Simpletax Review 2022 Savvynewcanadians

How To Do Your Wealthsimple Crypto Taxes In 2022 Koinly

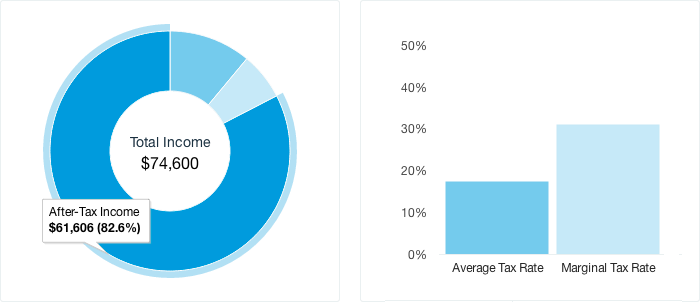

What Are Average And Marginal Tax Rates Wealthsimple

How To Do Your Wealthsimple Crypto Taxes In 2022 Koinly

Wealthsimple Tax Review 2022 Formerly Simpletax Greedyrates Ca

Wealthsimple Tax Review 2022 Formerly Simpletax Greedyrates Ca

How To Make A Budget Wealthsimple